I want to sell a property. What do I do first?

First of all, you need to receive a valuation to find out how much your home is worth. Ask them about the services they offer, the current state of the local market, and the purchase price you can hope you achieve. Make and plan and how this sits with your priorities and timescales.

How much is it going to cost to sell my property?

There are three main costs involved in selling a property

Estate Agent Fees:

Estate Agent Fees will either be a percentage of the purchase price, or a fixed fee. When you ask the estate agents to value your home, make sure they outline their fees during their visit so you can take these into account.

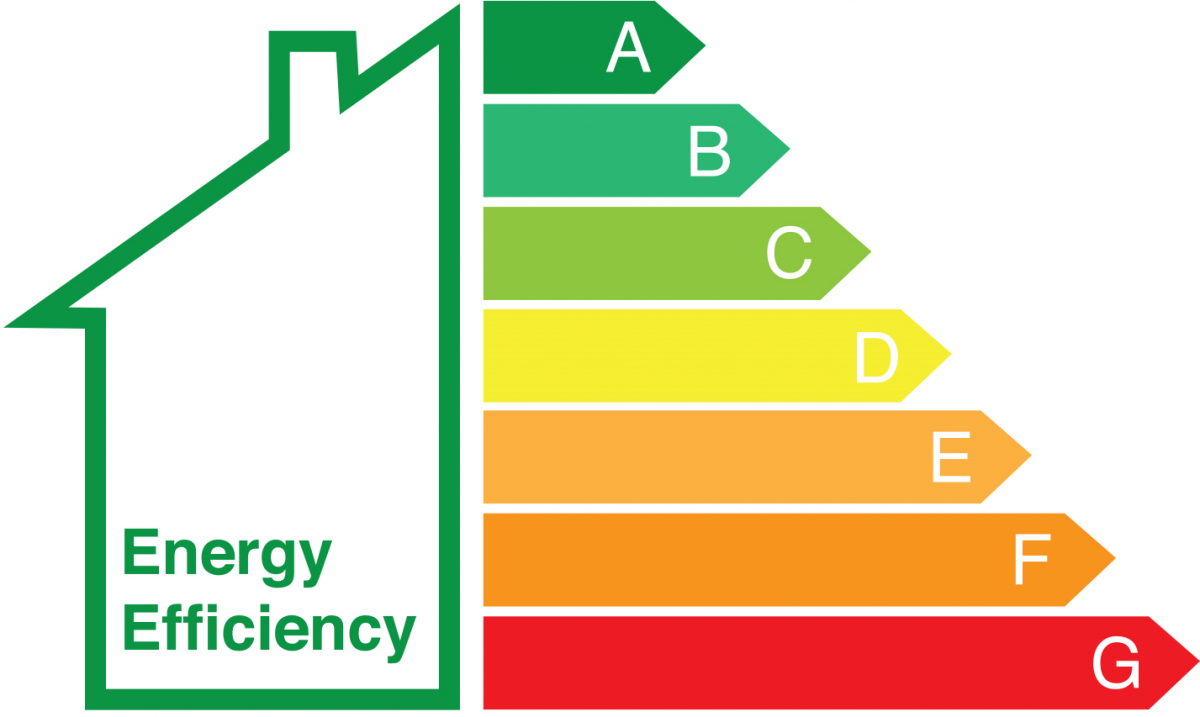

EPC:

You are legally required to provide an EPC when you market your property for sale. This outlines the energy efficiency rating of your property. Lawler & Co can organise this for you if you do not already have one. Contact your local branch for a quote for how much this will cost.

Conveyancing:

‘Conveyancing’ means the legal transfer of your property to the buyer, and you will need to employ a conveyancer to make this happen. Prices will vary depending on the circumstances of your buying and selling. Lawler & Co work closely with local solicitors and would be more than happy to get an accurate quote for how much this will cost just contact one of our offices.

Don’t forget about removals. Lawler & Co can also recommend a company to contact to get a quote.

Do I need to conduct viewings?

Your estate agent should accompany all viewings but you may decide that you’d like to be present as well. It’s entirely up to you.

Will there be more viewings once I’ve accepted an offer?

This depends on the conditions of the offer that you accept. Neither the buyer or the seller is bound to the purchase or sale until the contracts are signed, so it’s worth keeping your options open but we usually like to say, if the person(s) that have offered on your property have provided all proof of funds and Identification to your agent and they have incurred some cost i.e. survey or search then it would be advised to mark the property Sold Subject to contract and stop further viewings.

How long does it usually take to complete my sale?

Every sale is different. Both your situation and the buyer’s situation need to be taken into consideration before this question can be answered accurately. If your home has been realistically valued, you could expect to receive offers within the first four weeks. Then assuming your buyer has to apply for their mortgage the exchange of contracts normally takes between 4 and 6 weeks and completion takes between 2 and 4 weeks. So, you can realistically expect the process to take 12-14 weeks to complete.

Do I need an EPC?

In England, all sellers are required to purchase an EPC for a property before they sell it. Estate agents must display the EPC rating whenever they market the property. If a property does not have an EPC when marketed the buyer and the agent risk a fine. This does not apply to Grade II Listed properties.

Do I have to pay Stamp Duty?

No. It is the buyer’s responsibility to pay Stamp Duty but if you are purchasing a property then yes you will have to pay stamp duty for anything above £125,000.

Will my property be surveyed?

In England you do not need to arrange a property survey but it is likely that the buyer will, and so a surveyor will arrange an appointment to visit you home. The five key things a surveyor will be look at to ensure there are no issues are: utilities, damp, cracking, problems with roofs, and timber defects. In addition, your buyer’s mortgage lender will organise a mortgage valuation to confirm that the property is worth the money you are borrowing.

What are searches?

As part of the conveyancing process, your buyer’s conveyancer will perform searches of Land Registry and Local Authority information in relation to your home. They check planning history and any potential developments around roads, drainage and mining near the property.

When do I sign the contract?

When all of the steps listed previously are complete, you will be ready to sign the contract and agree the completion date.

When is the buyer or seller bound to the sale or purchase?

The seller or the buyer can pull out of the sale at any time and for any reason until the point that both conveyancers have received signed contracts from both parties this is also known as exchange of contracts.

How is a completion date chosen?

When both contracts have been signed, the buyer’s conveyancer will request the mortgage from their lender. Once these funds are released, then your solicitor and the buyer’s solicitor will consult both of you and agree a completion date.

Where are my title deeds?

Your title deeds give proof of ownership of the property and will need to be transferred to the buyer as part of the conveyancing process. These are usually held by your mortgage lender, and it will be your solicitor’s responsibility to obtain these.

What do I have to leave in the property?

You are not required to leave any furniture or furnishings in the property, but you may agree to include some as part of the negotiations of the sale please make sure that you check what you have agreed before you leave. The solicitors/conveyancers will send you a fixtures and fittings for so you can select what you are taking and leaving which will then be sent over to the buyer’s solicitor.

When do I have to move out?

As agreed by you and your buyer the contract will specify the completion day, usually the buyer will be asked to collect the keys to their new home from the estate agent. In most cases the seller is asked to vacate the property by 12pm.

Do I have to pay Capital Gains Tax?

In most cases you are only required to pay Capital Gains Tax if the property is not your main home.

The Hazel Grove office has been awarded

The Hazel Grove office has been awarded